A Complete Guide to RAK Free Zone Business Formation Costs

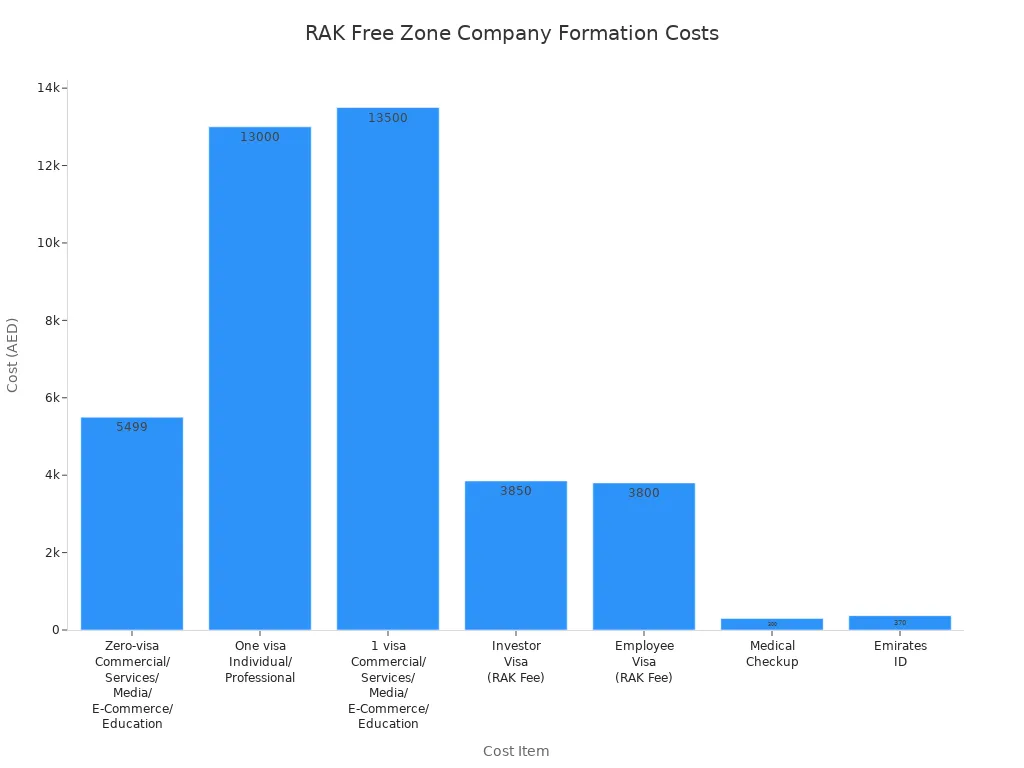

You can start a company in RAK Free Zone with packages from AED 5,499 for a zero-visa license. If you want a visa, prices start at AED 13,000. The table below shows the usual fees you may pay:

Item | Cost (AED) |

|---|---|

Zero-visa Commercial/Services/Media/E-Commerce/Education package | 5,499 |

One visa Individual/Professional package | 13,000 |

1 visa Commercial/Services/Media/E-Commerce/Education package | 13,500 |

Investor Visa (RAK Fee) | 3,850 |

Employee Visa (RAK Fee) | 3,800 |

Medical Checkup (for both) | 300 |

Emirates ID (for both) | 370 |

You should know all the costs before you start your business. Creative Business Solutions can help you with every step. They make the process easy and clear.

Key Takeaways

You can start a business in RAK Free Zone for a low price. Packages start at AED 5,499 for a zero-visa license.

You can pick bundled packages to save money on setup. These packages often give you licenses, office space, and help services.

Picking a flexi-desk can lower your office costs a lot. You still get a legal business address with this choice.

RAK Free Zone gives tax benefits. There is no corporate tax and no personal income tax. This helps you keep more of your profits.

You own your business fully in RAK Free Zone. You do not need a local sponsor. This means you have full control.

RAK Free Zone Costs

Minimum Setup Cost

You can start a business in RAK Free Zone with little money. The minimum setup cost changes based on your license type and office space. Many people pick the zero-visa package, which starts at AED 5,499. If you need a visa, the price starts at AED 13,000. These packages give you a basic license and shared office space.

To help you see the main costs, look at the table below:

Cost Component | Estimated Cost (AED) |

|---|---|

Business license fees | 11,000 – 15,000 |

Flexi-desk packages | Starting from 8,000 |

Visa packages | 3,000 – 5,000 per visa |

Additional government fees | Varies based on services |

RAK Free Zone has some of the lowest business setup costs in the UAE. Many business owners like this free zone because it is cheaper than Dubai. You can save up to 25% on yearly costs compared to other free zones.

💡 Tip: To save money, you can start with a flexi-desk package. This gives you a legal business address and shared office space. You do not have to pay for a private office.

Total First-Year Expenses

Your first-year costs in RAK Free Zone are more than just the license fee. You should plan for all main costs so you do not get surprised. Here is what you might pay in your first year:

Business license fee

Office or flexi-desk package

Visa fees if you need visas for yourself or workers

Registration and government charges

Medical checkup and Emirates ID for each visa

Many people choose the all-inclusive business setup package for AED 16,500 per year. This package covers the license, flexi-desk, and one visa. It helps you plan your budget. When you compare this to other UAE free zones, RAK Free Zone is more affordable for new businesses.

Note: Your real costs may change based on your business type, how many visas you need, and extra services you pick.

Picking RAK Free Zone helps you save money and still get all the benefits of a UAE business license. You can use the money you save to grow your business or invest in other things.

License Fees

Picking the right license is very important when you start your business. Each license type in RAK Free Zone has its own price. Each one lets you do different things. You need to know what each license lets you do. You also need to know how much it costs.

Commercial License

A commercial license lets you bring in, send out, and sell products or services. This license is good if you want to trade goods in the UAE or other countries. The price for a commercial license starts at AED 6,000. It can go up to AED 15,000. The price depends on what your business does and how many things you want to do.

License Type | Description |

|---|---|

Trading | Lets you buy and sell goods in the UAE or other countries. |

Commercial | Lets you bring in, send out, and sell products or services. |

Note: If you add more activities, the fee goes up.

Industrial License

If you want to make, put together, or pack goods, you need an industrial license. This license is for companies that make or pack things. The price for an industrial license is between AED 25,000 and AED 45,000. You must pick your business activity from a list. Your company can be a Free Zone Company (FZC) or a Free Zone Establishment (FZE).

Cost Range (AED) | Eligibility Requirements |

|---|---|

25,000 - 45,000 | Pick an approved activity; Be an FZC or FZE |

Service License

A service license is best if you give services like consulting, marketing, or IT help. This license covers many jobs. The price for a service license starts at AED 6,000. It can go up to AED 15,000. The price depends on what services you choose.

License Type | Description |

|---|---|

Service | For businesses that give services like marketing, consulting, or IT. |

Tip: Service licenses are flexible and work for many businesses.

Specialized Licenses

Specialized licenses include general trading and e-commerce licenses. A general trading license lets you trade many kinds of products. There are no limits. An e-commerce license helps you run a business online. These licenses also start at AED 6,000. They can go up to AED 15,000.

License Type | Description |

|---|---|

General Trading License | Trade many kinds of products with no limits. |

E-Commerce License | Sell products or services online. |

License fees in RAK Free Zone depend on what your business does, how many things you do, and your company type. You should look at your choices and pick the license that fits your business.

Office Space Options

Choosing the right office space is a key step when you set up your business. The type of office you pick will affect your total costs and how your company works every day. Here are the main options you can choose from in RAK Free Zone:

Type | Cost (AED) | Frequency |

|---|---|---|

Flexi Desk | 12,500 | Yearly |

Private Office | 19,000 | Yearly |

Warehouse Space | 245 per m² | Yearly |

Flexi Desk

A flexi desk gives you a shared workspace and a legal business address. You can use meeting rooms and basic office services. This option is the most affordable for new businesses. You pay about AED 12,500 per year. Flexi desks work well if you do not need a full-time office. You can save money and still meet all legal needs.

💡 Tip: Flexi desks are great for startups or solo entrepreneurs who want to keep costs low.

Private Office

A private office gives you your own space. You get more privacy and control. The yearly cost is about AED 19,000. Private offices suit companies that need a quiet place or want to show a professional image. You can set up your office the way you like. This option costs more, but it can help your business grow.

Warehouse Space

Warehouse space is best for companies that store goods or need space for packing and shipping. The cost is AED 245 per square meter each year. You can choose the size that fits your needs. Warehouses are good for trading, manufacturing, or logistics businesses.

Your choice of office space will change your total setup cost. Here is how each option affects your budget:

Flexi Desk: Most affordable, helps you save on rent.

Shared Office: Costs more than flexi desk, but less than private office.

Private Office: Higher cost, gives you privacy and a fixed space.

Warehouse: Best for storage, price depends on size.

The office you choose in RAK Free Zone will shape your business costs and daily work. Pick the option that matches your needs and budget.

Additional Fees

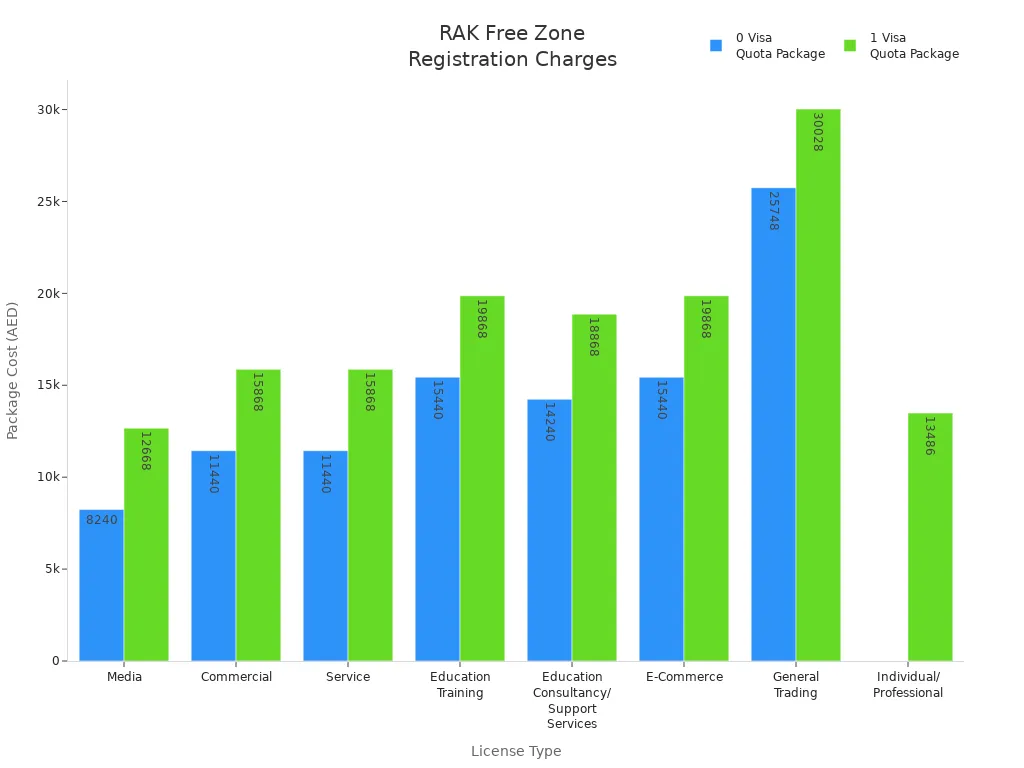

Registration Charges

You have to pay registration charges when you start your company in RAK Free Zone. The amount depends on your license type and how many visas you want. The table below shows the usual costs for each license:

License Type | 0 Visa Quota Package Cost | 1 Visa Quota Package Cost |

|---|---|---|

Media | AED 8,240 | AED 12,668 |

Commercial | AED 11,440 | AED 15,868 |

Service | AED 11,440 | AED 15,868 |

Education Training | AED 15,440 | AED 19,868 |

Education Consultancy/Support Services | AED 14,240 | AED 18,868 |

E-Commerce | AED 15,440 | AED 19,868 |

Individual/Professional | N/A | AED 13,486 |

General Trading | AED 25,748 | AED 30,028 |

If you need more visas or a special license, the price is higher.

Visa Packages

Visa packages in RAK Free Zone help with different needs. You can get visas for yourself, your workers, or your family. Each package gives you an Emirates ID, a medical test, visa processing, and license renewal. Here are the main choices:

Visa Type | Description | Cost (Starting) | Additional Costs Included |

|---|---|---|---|

Investor Visa | For business owners | N/A | Emirates ID, medical test, visa processing, license renewal |

Employment Visas | For staff and workers | N/A | Emirates ID, medical test, visa processing, license renewal |

Dependent Visas | For family members | N/A | Emirates ID, medical test, visa processing, license renewal |

Entry-level Package | Zero-visa setups | AED 5,750 | Emirates ID, medical test, visa processing, license renewal |

Tip: Plan for visa costs early if you want to bring workers or family.

Bank Account Setup

You need to open a business bank account after you register your company. Banks in RAK Free Zone ask for some documents. You must show your trade license, company papers, and proof of address. You also need Emirates ID and passport copies for everyone who signs. Most banks want an initial deposit. This deposit is usually between AED 3,000 and AED 10,000. The amount depends on the bank and account type.

Type | Details |

|---|---|

Company Documents | Trade license, company papers, board resolution, stamp, letterhead |

Personal Documents | Emirates ID, passport, visa, salary or income proof, bank reference |

Initial Deposit | AED 3,000 – AED 10,000 |

Other Requirements | Proof of address, business plan, expected transactions |

Renewal Fees

You must renew your RAK Free Zone license every year. Renewal fees depend on your license type and how big your business is. Most companies pay between AED 4,000 and AED 14,000 each year.

Renewal fees change based on what your business does.

You should plan for these yearly costs to keep your company open.

Renewal means you update your license and office lease.

Note: Always check the latest renewal fees for your license type so you do not get surprised.

RAK Free Zone Formation Steps

Starting a business in RAK Free Zone has clear steps. You can follow each step to make things simple. Here is what you should know.

Pre-Approval

First, you pick your business activity and company structure. You choose if you want an FZC, FZE, or branch office. Next, you pick your office type. This could be a virtual office, flexi desk, or executive office. After you decide, you send your application for approval. The first license fee is usually from AED 6,000 to AED 15,000.

Step | Description | Associated Costs (AED) |

|---|---|---|

Select Activity | Say what your business will do | N/A |

Choose Structure | Pick FZC, FZE, or Branch Office | N/A |

Select Facility | Choose your office type | N/A |

Submit Application | Send your documents for approval | N/A |

Initial Approval | Get permission to move forward | 6,000 - 15,000 |

Documentation

You need to get some documents ready for your application. These are:

Passport copy

Entry visa or permit

Passport photo for each shareholder

Emirates ID if you have one

Three company name ideas

You collect these papers and send them with your application. The license cost at this step is between AED 6,000 and AED 20,000. The price depends on your business type.

License Issuance

After you send your documents, the review starts. It takes about 2 to 3 days to get first approval. Then you pay the final fee. You get your license in 7 to 10 working days after you send everything. The total license cost is between AED 15,000 and AED 25,000. The price depends on your company type and what you need.

⏳ Tip: Get your documents ready early to finish faster.

Post-Setup

When you get your license, you can open a business bank account. You can also start your business. You may need visas for yourself or your workers. Visa costs are from AED 3,500 to AED 5,000 for each person. You must renew your license and office lease every year to keep your company open.

📝 Note: Renewing every year keeps your business legal and running well.

Cost-Saving Tips

It is important to save money when you start a business. There are many ways to spend less and get more for your money. Here are some tips that can help you.

Bundled Packages

You can pick bundled packages to lower setup fees. RAKEZ and Creative Business Solutions have special deals for new business owners. These packages give you licenses, workspaces, and support programs. You get everything in one deal, so you do not pay extra charges.

Package Name | Cost (AED) | Features |

|---|---|---|

Mubader Package | 650 | Business license, workspace, support programs for young entrepreneurs. |

Business Setup Package for Women | 6,200 | Free zone permit, sharable workstation, additional services, and support for female entrepreneurs. |

You can choose a package that matches what you need. These deals help you start your business with less money.

💡 Tip: Creative Business Solutions can help you pick the best package. Their team knows how to match your goals with the right offer.

Multi-Year Discounts

You can save more by picking a multi-year plan. If you pay for three years at once, you get a 25% discount on your license and office space. This means you spend less over time and avoid yearly price increases.

You get a 25% discount for a 3-year package for licenses and office space.

You lock in your costs and protect your budget.

This choice is good if you want to run your business for many years. You keep your costs low and make your money last longer.

Shared Facilities

Shared facilities help you spend less on rent and office supplies. You can use flexi facilities or standard offices in business centers. These spaces are ready to use and have furniture and equipment.

Facility Type | Description | Benefits for Cost Savings |

|---|---|---|

Flexi Facilities | Shared and furnished workstations in business centers. | Low initial investment, ideal for startups. |

Standard Offices | Ready-made office spaces for small to medium-sized businesses. | Reduces operational expenses and maximizes ROI. |

You do not need to buy furniture or pay for big offices. Shared spaces let you focus on your work and spend less on setup.

📝 Note: Using shared facilities in RAK Free Zone helps you start your business fast and keep your costs low.

Financial Benefits

Tax Advantages

You get big tax benefits in RAK Free Zone. You do not pay corporate tax, so you keep all your profits. There is no personal income tax, so you and your workers take home more money. You can send your profits anywhere in the world with no limits. You do not pay import or export tax, so you save money when you bring in or send out goods. These tax breaks help your business make more money and grow faster.

💡 Tip: Tax exemptions in RAK Free Zone can last up to 15 years. This helps you save money for a long time.

Zero corporate tax

No personal income tax

Full profit repatriation

Import and export tax exemptions

100% Ownership

You have full control of your company in RAK Free Zone. You do not need a local partner or sponsor. You make all the choices for your business. You can add partners or change owners easily. Your assets are safe from state claims. You also keep your business details private. Many international investors like this freedom. It keeps their investments safe and gives them more choices.

Benefit | What It Means for You |

|---|---|

Full control | Make all business decisions yourself |

Confidentiality | Keep your business information safe |

Asset protection | Secure your investments |

Easy ownership transfer | Add or change partners anytime |

Low Operating Costs

RAK Free Zone helps you spend less money to run your business. You pay less for licenses and office space than in other UAE free zones. The Biz Starter package starts at only AED 5,499. You get modern offices and good infrastructure. The free zone supports many types of businesses, like trade, services, and industry. You also get great logistics and easy access to ports and airports. These things help you run your business well and save money every year.

Competitive operating costs

Affordable company setup packages

Efficient infrastructure and logistics

Support for many business sectors

📝 Note: Lower costs mean you can put more money into your business. You can also reach global markets more easily.

When you start a RAK Free Zone Business Formation Costs you pay for different things. You need to pay license fees, office space, visa packages, and registration charges. If you plan your budget, you will not be surprised by costs. RAK Free Zone lets you save on taxes, own your business fully, and spend less to run it.

Ask Creative Business Solutions for help to make setup easy.

Pick bundled packages and shared spaces to spend less money.

📞 Contact us now to get your own quote and begin your business journey with confidence!

FAQ

What is the cheapest way to start a company in RAK Free Zone?

You can choose the zero-visa package. The cost starts at AED 5,499. This option gives you a basic license and shared workspace. You save money and meet legal requirements.

Do I need a local sponsor for my RAK Free Zone company?

You do not need a local sponsor. You can own your company 100%. This gives you full control over your business and assets.

How long does it take to set up a business in RAK Free Zone?

You can finish setup in 7 to 10 working days. You must prepare your documents and pay the fees. Creative Business Solutions helps you complete each step quickly.

What documents do I need for registration?

You need a passport copy, entry visa, passport photo, Emirates ID (if available), and three company name ideas. You must submit these with your application.

Are there any hidden costs I should know about?

You should plan for renewal fees, visa charges, and bank account deposits. Ask Creative Business Solutions for a full breakdown. This helps you avoid surprises.